First there were Smart Contract Audits, then there were KYC Audits.; Fundamental Analysis (FA) Audits are the natural next step in the evolution of Audit Certification. The FA Audit Certificate is our first-to-market innovative solution delivering visibility for some key fundamentals of projects in an easy-to-understand format. They operate in seamless alignment with other audits and provide investors (retail and institutional) the extra confidence your product has been analysed and rated at a fundamental level.

Project Founders love the marketing and community growth potential of this as it complements well with KYC and Security Audits. Retail investors at all experience levels appreciate the concept and design. Projects with a triumvirate of audit certificates show elevated community strength, and increase attractiveness to investors.

Our Audits are delivered with an NFT which grants full ownership rights to the content within. As well as the Audit Certificate (in .PNG format), it also includes a Fundamental Analysis report (in .PDF format) providing a comprehensive breakdown of your solution at the fundamental level. For information on the breakdown of our FA Reports please visit that section here. For the full complement of our FA Audits, this is available to our subscribers here.

The Client can use the content within the NFT for any purpose; Including marketing material on their website, whitepaper, social media channels etc.

Services included with the Audit:

- Up to 2 Years of updated FA Reports and Audit Certificates at no extra cost

- Bear market discount rates currently available

- Access the MGH Consulting network for investment, partnership & marketing opportunities

- Exposure to communities MGH Consulting are active in

- At your request we can bring your Report from behind the paywall and publish as a Blog post

- Generating awareness through our Social Media activity highlighting your project’s key USPs

To complete the most accurate assessment possible, it is likely a member of the development team will need to be made available to MGH to answer relevant questions during research conducted by our expert team.

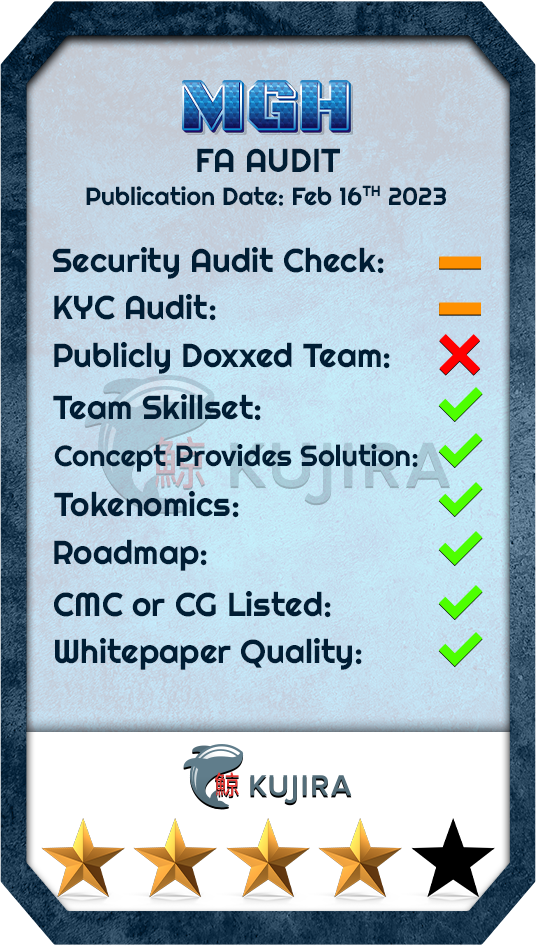

Our Audit covers nine key areas of research in a pass / fail / to be improved rating as shown in the example provided below.

Audit Certificate Breakdown

Security Audit Check:

Has the project undergone an independent security audit? If so, is the audit is of a sufficient quality of diligence? Has the audit identified any risks not resolved or mitigated by the team? Have they listed the responses from the team in the report? Does the audit report include the full scope of tests completed? Does the audit check for centralisation risks? Do the auditors have a history of missing vulnerabilities, resulting in hacks or exploits of other Projects?

KYC Audit:

Has the project has undergone a KYC audit? Has the auditor performed full diligence to verify identification of the Founders and Lead Developer/Engineer at a minimum? Does the auditor update a KYC when signatories of a multi-sig wallet change hands? Does the auditor have a history of providing KYC to teams which still rugpull their investors? If an anon team without a KYC, do they have sufficient history with tokens/coins fully vested to the team to still warrant a KYC?

Publicly Doxxed Team:

Have the founders and senior members of the team publish their relevant personal information (qualifications, skills, experience, prior employment etc) on the website, and independent platforms such as LinkedIn? Is information on the team members, their roles and responsibilities easily accessible to the average person? Do the Founders and senior members of the team provide information to contact them directly?

Team Skillset:

Have the team proven delivery of their concept? Have previous roadmap targets been met on time? Have the team innovated new technology to bring to market? Does the team consist of sufficiently qualified, skilled and experienced individuals to make a concept become reality? Has the project formed viable partnerships which elevates its service? If the team is anonymous, have they proven their worth over the prior 2 years? If the protocol is open-source, have there been sufficient commits in GitHub to indicate a hardworking and developing team? Do the Founders have a history of failed or rugged Projects? Are the team actively engaged and responsive with their community? Do the team proactively inform their community with updates and changes?

Concept Provides Solution:

Does the project offer a solution to real world problems? Has the project innovated a new concept to bring to market? Are they entering a saturated market late? Is there a likelihood of wide adoption? Does the concept attract strong community support? Are they capitalising on a current trend by copying first movers? Is the project sufficiently decentralised to protect it from bad actors and hostile regulation? Is the concept of the protocol entering into a market of negative interest/trend?

Tokenomics:

Does the project provide full disclosure of the economic model of the project? Are the revenue streams sufficient to make it sustainable today? Is there a hard cap on the token/coin supply? Does the vesting of the token/coin indicate risk of market saturation? What is the TVL as a percentage of market cap? How and when do the tokens/coins unlock, and whom do they unlock for? In a percentage, how much of their token/coin supply have they allocated to themselves, their advisors, early and private investors? Is there an inflationary emission? Is the token/coin fully circulating with no further vesting or emissions? Is there a deflationary burn (or buy back and burn) mechanism? If inflationary, can it become deflationary in the future? Have they hard forked to a new tokenomic structure in the last 2 years? If so, has it proven beneficial?

Roadmap:

Does the project have a publicly visible roadmap? If so, have they released a long term vision? Are their goals achievable and realistic? Have they completed prior targets set? Do they update their roadmap on a regular basis? Does the vision show ambition to disrupt and innovate? Do the team adapt their roadmap to changing market conditions?

CMC or CG Listed:

Have they listed verified contract information onto coinmarketcap.com or coingecko.com? Included all relevant links to social media, documentation (such as whitepaper)? And integrated an oracle feed or API to provide up-to-date tokenomic information such as circulating supply, total transaction volume, and marketcap?

Whitepaper Quality:

Does the whitepaper include all the information required of the project? This should include Mission; Problem; Solution; USPs; Team; Advisors; Partners; Investors; Roadmap; Tokenomics; Contract Information; Audit Links; External Reference Links. Even if all the above is included, is the quality and depth to a sufficient standard?

Real FA Audit Certificate Example: